The Future of Operations

Download the ReportMaximise Value From The Cloud With A Strategic Mindset

The Future of Operations: Maximise Value from The Cloud with a Strategic Mindset is a commissioned Forrester Consulting study conducted on behalf of Crayon’s APAC channel organisation. It provides a 24-month forward view of cloud adoption plans by small-to-medium sized businesses across the region and highlights what drives their choice of technology service provider. In this article, we break down some of the key findings in the report.

Executive Summary.

SMB cloud adoption is up across Asia Pacific and is driving bottom line outcomes. Those implementing cloud platforms and solutions before and during COVID are statistically more likely to have experienced double digital revenue growth over the past two financial years than businesses yet to adopt. SMBs equate cloud adoption with improved business agility, operational resilience, workforce efficiency, cost effectiveness and market competitiveness.

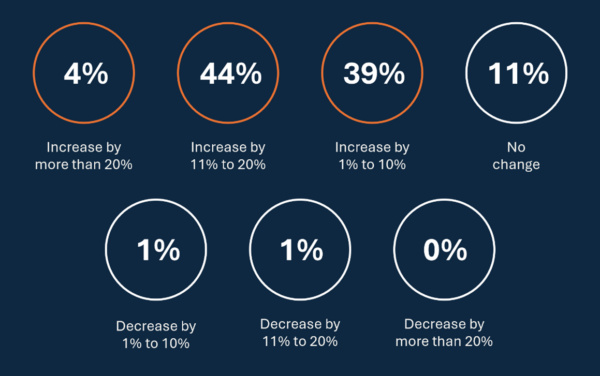

As such, 83% of SMBs intend to maintain or increase investment in cloud platforms and solutions. A hybrid cloud strategy is the most pursued to support critical business objectives; improving customer experience, growing revenue, and improving the skills and capabilities of their employees.

Barriers to Cloud Powered Growth.

However, the majority of SMBs acknowledge they lack the people, process and technology maturity needed to sustain value realisation from continued investment.

Security, strategy and skills are significant challenges SMBs face in their bid to continue driving value from continued cloud adoption.

Transformation vision is not the hurdle. SMBs are wrestling to get the right technology strategy in place that will take vision into action. Further, results from the study indicate SMBs are aware they lack the knowledge, and internal skill sets to turn technical action into measurable business outcomes.

Security and Continuity are the priority.

Investment in cloud-based productivity and business applications solutions surged during the pandemic. SMBs are now pivoting their investment priorities into reducing cybersecurity risk and improving business resilience. Budgets for new or expanded use of solutions and tools in the security and continuity domains is projected to remain on the rise through to the end of 2025.

Adoption intent indicated through survey responses shows increased demand for encryption, extended detection and response (EDR), hybrid cloud storage and end-point backup in particular.

Budgets for partners are up, but selection criteria have changed.

Identified challenges for SMBs is driving demand for third party service providers, with 88% of survey respondents intending to increase budget allocations over the next 24 months.

Cloud capabilities are a clear competitive advantage when it comes to securing SMB engagement, yet the criteria for the selection of partners is changing as SMBs pivot to a more strategic view of their cloud investments.

Decision makers are less interested in whether they have the latest technology and more motivated to ensure they’re doing better things with their existing solutions. There is less emphasis on project to project, and more value placed on long term engagements with partners that offer more than infrastructure hosting and uptime assurance.

SMBs overwhelmingly seek partners that can provide cloud strategy development, backed with capabilities in hybrid and public cloud. As the use of cloud amongst SMBs grows, there is increased demand for partners with cloud cost optimisation offerings.

The reasons behind a decision to engage a partner fall into four main categories, cost, time, expertise and access. The two most highly ranked responses across all drivers shows that expertise is the most important to SMBs, followed equally by time and access.

In what may be surprising news to some partners, cost is the least influential factor.

What does this mean for our partners?

The proven the bottom-line results of investment in cloud technology has proved a tipping point for SMBs. As a result, SMBs remain driven to scale their cloud adoption despite continued economic uncertainty.

At the same time, SMBs are savvier about how to determine the value of their technology investments. They’re looking for partners that can strategically leverage full value from existing cloud and software estates. Partners that can position their cloud consulting capabilities and demonstrate cloud cost optimisation outcomes are primed to outperform in the market.

The increased demand for cybersecurity solutions and services will prove challenging for some partners to address. Cybersecurity is a complex domain with numerous areas of hyper-specialised technical knowledge involved. Crayon’s channel team can provide partners with the means to get underway by leveraging our cybersecurity assessment offerings. We have the largest team of in-house cybersecurity experts of any distributor in the region, which means partners are fully supported to implement recommendations needed to improve customer cybersecurity posture.

Partners should also anticipate increased solution convergence in the cybersecurity and business continuity domains, as vendors respond to the increased need for integrated offerings that reduce risk and build resilience. Customers will look to their partners for strategic and technical guidance on how to knit the security and protection of their organisations more closely together. Crayon’s integrated Risk and Resilience solutions and services approach ensures we are well positioned to support partners in this regard.

For all the details from the Forrester study, download the full report now.